Airbnb (ABNB): Strong Fundamentals and Attractive Valuation

In today’s evolving financial landscape, Airbnb (ABNB) continues to stand out as a promising stock, especially given its recent performance and solid fundamentals. Whether you’re an experienced investor or just starting out, understanding why ABNB could be a great addition to your portfolio is key. Let’s dive into why this stock offers significant potential for growth and value.

1. Market Cap and Industry Position

With a Market Cap of $86.20 billion, Airbnb is positioned as a dominant force in the travel and hospitality sector. Despite economic fluctuations, Airbnb has maintained its leadership in a highly competitive industry, demonstrating both resilience and growth potential. Its platform has changed how millions of people travel, offering more flexible and personalized accommodations worldwide.

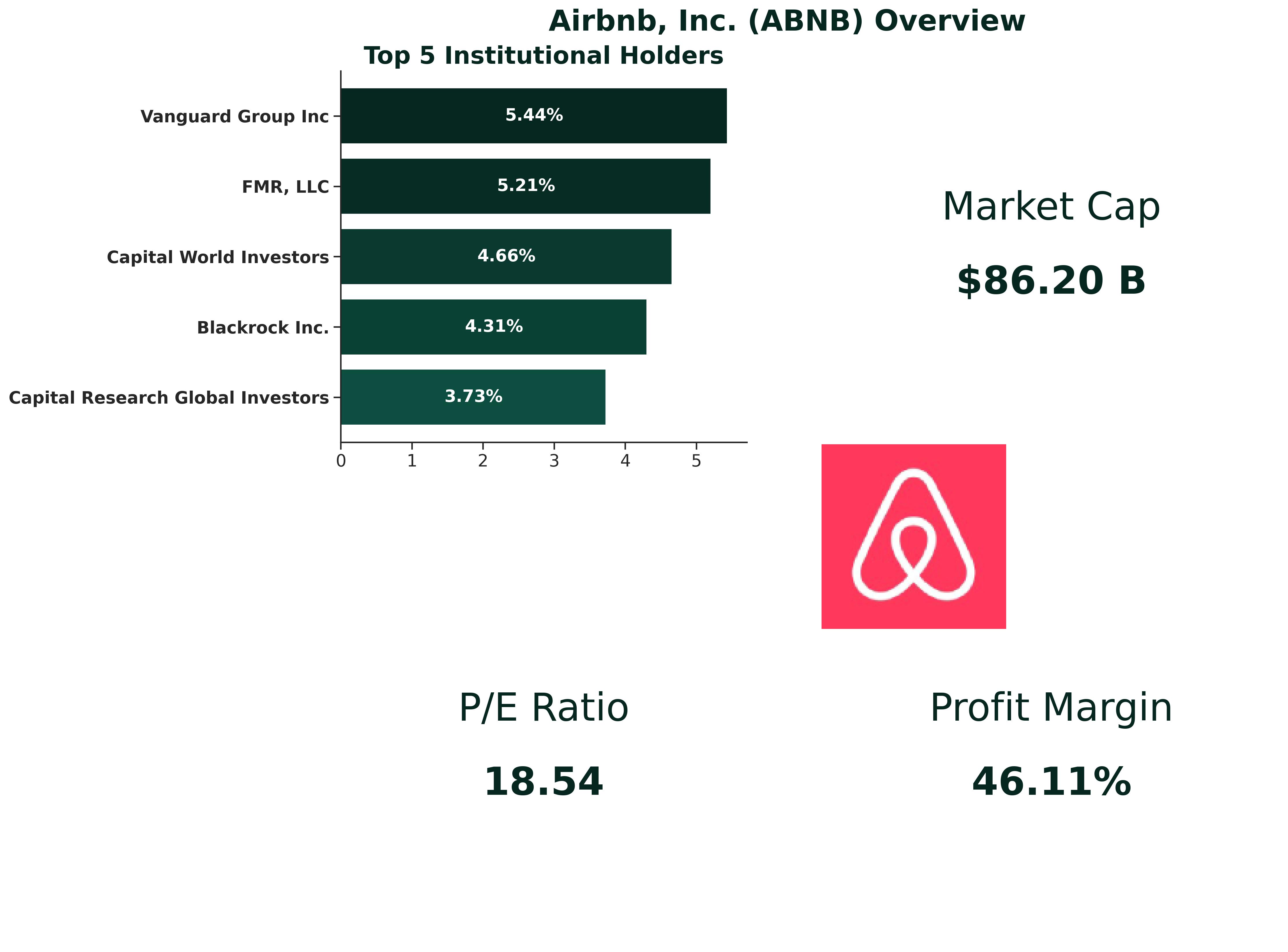

Figure 1: Overview of Airbnb's institutional holders, market cap, P/E ratio, and profit margin.

This chart (Figure 1) showcases the top 5 institutional holders, reinforcing the strong backing of companies like Vanguard and BlackRock. The P/E ratio of 18.54 demonstrates that Airbnb is still attractively valued compared to its industry peers, and the exceptional profit margin of 46.11% signals operational efficiency, which is a notable strength for a tech-oriented hospitality company.

2. Strong Profit Margins and Operational Efficiency

One of the most compelling aspects of Airbnb’s financials is its impressive profit margin of 46.11%. This is a clear indication of efficient operations and the ability to convert a large portion of its revenue into profit. In comparison to many other tech companies, Airbnb stands out by showing that it's not just about growth but also about profitability.

3. P/E Ratio: A Good Value

At a P/E ratio of 18.36, Airbnb is attractively valued when compared to other tech giants and the broader market. A P/E ratio in this range typically indicates that the stock is priced fairly relative to its earnings, making it an appealing investment for those looking for value without sacrificing growth potential.

4. Return on Equity (ROE) and Return on Assets (ROA)

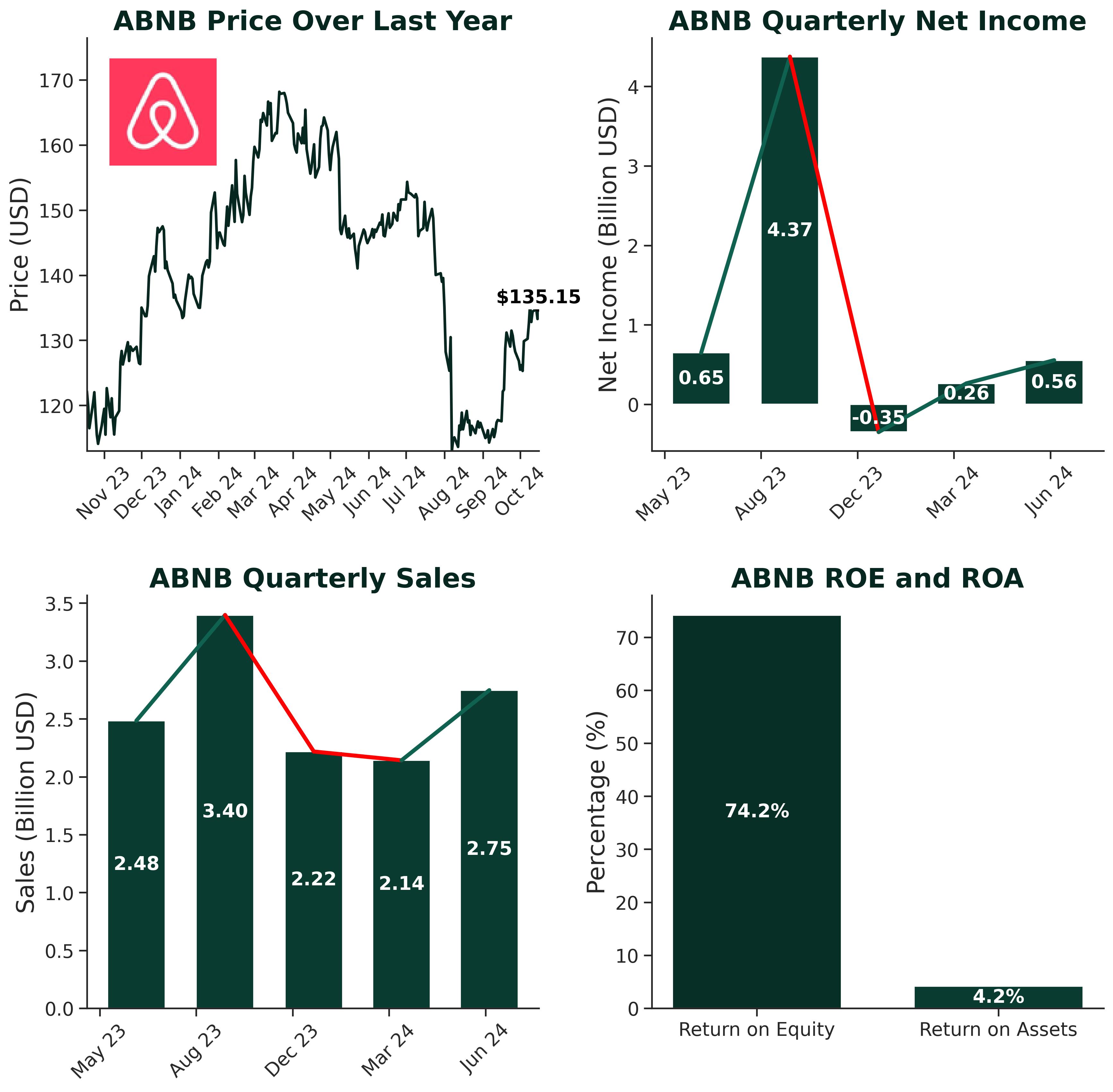

Airbnb’s Return on Equity (ROE) of 74.2% is nothing short of exceptional, demonstrating that the company is highly effective at generating profits from shareholders' equity. This high ROE signals that Airbnb is making good use of its investments to produce substantial returns for its investors.

Meanwhile, its Return on Assets (ROA) stands at a respectable 4.2%, showing that Airbnb is also efficient at using its assets to generate profits. This balance between ROE and ROA speaks to Airbnb’s overall financial health and operational efficiency, further solidifying its status as a strong contender in the market.

Figure 2: Financial overview of Airbnb, showing price, net income, sales, ROE, and ROA.

Figure 2 highlights Airbnb’s financial trajectory, with an emphasis on ROE and ROA. The remarkable ROE (74.2%) showcases Airbnb's efficient profit-generation from shareholders’ equity, a major factor in the company's attractiveness for long-term investors. Additionally, sales growth, despite quarterly fluctuations, underscores the platform's resilience and adaptability in the current economic climate.

5. Steady Sales Growth

Despite some short-term fluctuations, Airbnb has shown consistent quarterly sales growth, with recent sales hitting $2.75 billion. This steady increase, particularly in a post-pandemic environment, indicates that Airbnb is recovering and adapting to the changing travel landscape.

As global travel restrictions continue to ease, and with Airbnb’s unique ability to offer both short-term rentals and long-term stays, we can expect sales to continue growing, bolstered by increasing demand for flexible travel and remote work accommodations.

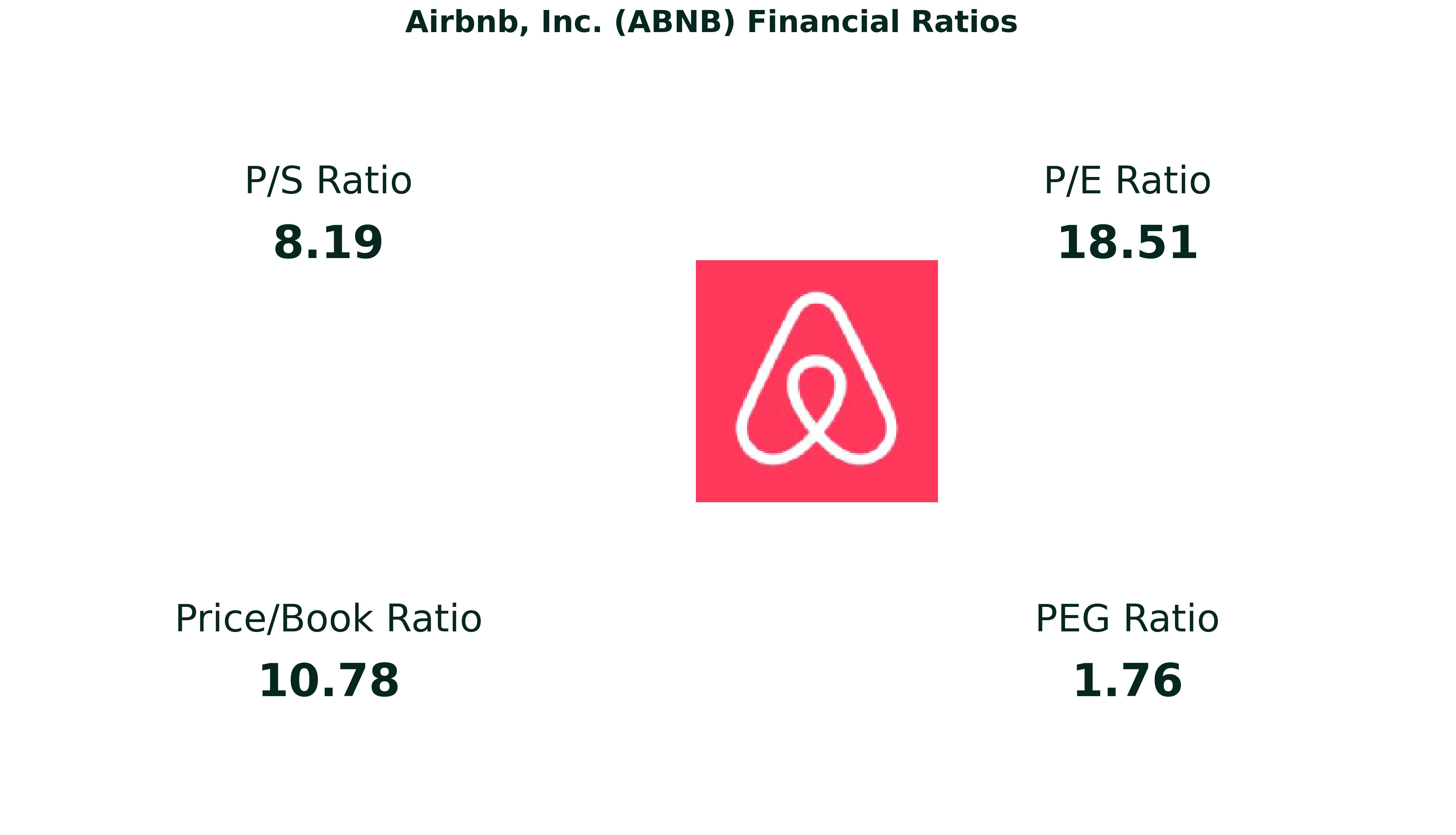

Figure 3: Financial ratios of Airbnb, showing P/S, P/E, PEG, and Price/Book ratios.

In Figure 3, Airbnb's key financial ratios are displayed, offering insight into its valuation metrics. The P/E ratio of 18.51 highlights a strong earnings potential, while the Price/Book ratio of 10.78 suggests that Airbnb's assets are being leveraged for high returns. Moreover, the PEG ratio of 1.76 indicates a good balance between price and expected earnings growth, making Airbnb an appealing investment for growth-focused investors.

6. Institutional Confidence

It’s also worth noting that major institutional investors like Vanguard Group and BlackRock hold significant stakes in Airbnb, with Vanguard holding over 5.44% of shares. This strong institutional backing is a good sign for retail investors, as it suggests confidence in Airbnb’s future growth and stability.

7. Airbnb’s Adaptability and Market Expansion

Beyond the numbers, Airbnb’s ability to adapt to market trends is another reason to consider this stock. The company has expanded its offerings into experiences and has plans to explore new verticals like transportation, giving it additional revenue streams beyond accommodation bookings.

Moreover, as more people opt for remote work and digital nomad lifestyles, Airbnb’s appeal grows. The company is uniquely positioned to benefit from these evolving travel and living trends.

Conclusion: Why Airbnb (ABNB) Has Solid Investment Potential

With a strong market position, impressive profit margins, and a fair valuation, Airbnb offers a combination of growth and value that’s hard to ignore. The company’s adaptability and ability to innovate make it a long-term play in the travel and hospitality industry, while its strong fundamentals suggest that it’s not just a growth stock but a financially sound one too.

For investors looking for exposure to the tech-driven travel sector, Airbnb provides an attractive opportunity. Whether you’re seeking growth, profitability, or a mix of both, ABNB is a stock worth keeping on your radar.